WHEAT Reversal Trade 28 May 2020: 2.07R Partial Profit Taken

Heavy global wheat supplies have dominated headlines depressing wheat price. However, the current Covid-19 pandemic and unfavourable weather condition may tilt the supply demand imbalance toward a higher wheat price moving forward.

- The low wheat price has already resulted in fewer acres planted in 2020.

- Unfavourable weather condition has put wheat yields at risk for a production downgrade further reducing the supply.

- The Covid-19 pandemic has caused a spike in global wheat demand as global lockdown measures required more at-home cooking.

|

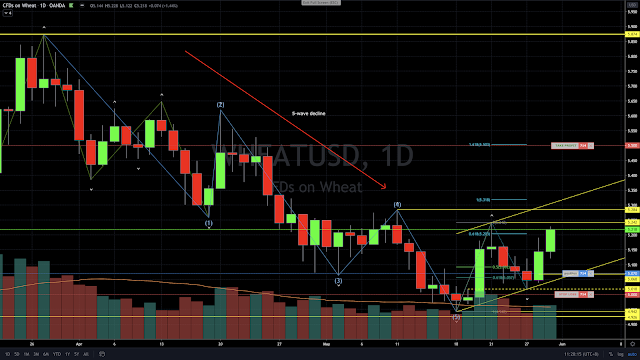

| WHEAT Daily Chart |

|

| WHEAT 4-Hour Chart |

WHEAT surged up during the May 28, 2020 CBOT pit session. The next day it consolidated early on but began to move up again later in the day. I entered a limit order at 5.215 to close half my position and the order was filled May 30, 2020 for a +0.145 gain giving me a 2.07R trade in two days. It turned out to be near to the day high.

I still have half of my position opened. With favourable fundamental to back a higher wheat price, I decided to raise my TP target for my remaining position to 5.50. I am expecting a move higher to take out the previous swing high at 5.284. Student of Elliot wave principle would know that I have set the target based on the typical 1.618 Fibonacci extension target for a wave 3 impulse move. I believe that the current up move is likely to be a wave 3 impulse move

Disclaimer:

Trading and investment involves risk, including possible loss of principal and other losses. I shall not be responsible for any losses or loss profit resulting from trading or investment decision based on my posting and any information presented in this blog.

Comments

Post a Comment