WTI 24 May 2021 Short Trade -1.0R Loss

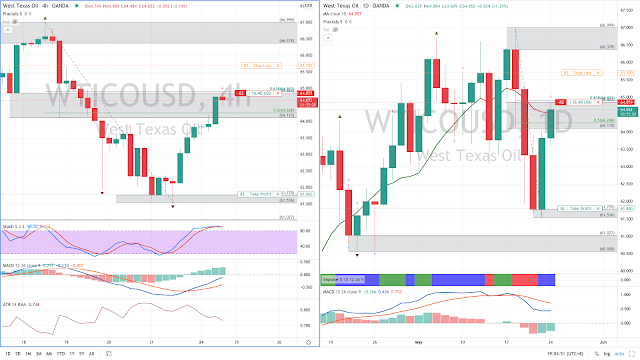

WTI Crude Oil charts showed the following when the trade was considered on 24 May 2021.

Daily chart: 10-day MA was angling down.

4-hr chart: Role reversal S/R zone was tested after stochastic %K rallied to >80. The S/R zone coincided with the Fibonacci 0.50-0.618 retrace level.

The trade plan was to enter short at the role reversal S/R zone with a stop 1x ATR above entry and take profit at the next opposing S/R zone.

ENTRY:

|

| WTI Daily and 4-hr Entry Charts |

Entered short at 64.859 at the role reversal S/R zone on 24 May 2021 18.17hr MYT. Stop was placed at 65.70, which was 85 pips above entry based on 1x 14-bar ATR. Take profit was placed at 61.80 at the next opposing S/R zone.

EXIT:

|

| WTI Daily and 4-hr Exit charts |

The trade setup failed. It briefly declined but later moved up to hit my stop at 65.701 on 25 May 2021 00.35hr MYT. The trade loss was -1.0R.

Disclaimer:

Trading and investment involves risk, including possible loss of principal and other losses. I shall not be responsible for any losses or loss profit resulting from trading or investment decision based on my posting and any information presented in this blog.

Comments

Post a Comment