GBPNZD 14 May 2021 Long Trade +2.78R Profit

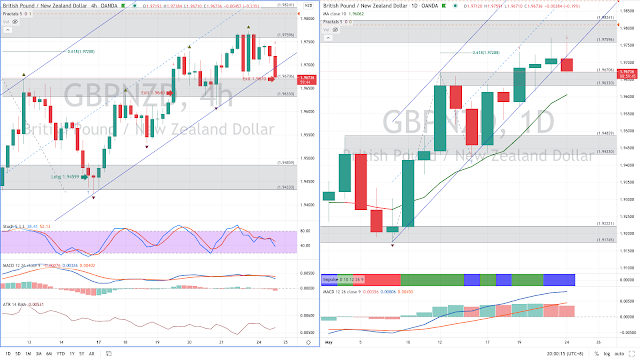

GBPNZD charts showed the following when the trade was considered on 14 May 2021.

1. Daily chart: 10-day MA was angling up. Price retraced to role reversal S/R zone.

2. 4-hr chart: Role reversal S/R zone was tested after stochastic %K declined to <20.

The trade plan was to enter long at the role reversal S/R zone with stop placed 1x ATR below entry and take profit placed at the next opposing S/R zones.

|

| GBPNZD Daily and 4-hr charts |

ENTRY:

Entered long at 1.94599 on 14 May 2021 22.13hr MYT at the role reversal zone after stochastic %K declined <20. Stop was placed 70 pips below entry at 1.9390 based on 1x 14-bar ATR. Take profit was placed at 1.9640 at the next S/R zone.

EXIT:

The exit strategy was adjusted to a trailing stop mid-way through the trade. The basis for this was the currency index was showing GBP as the strong and NZD as weak based on 10-day performance, which suggested that the GBPNZD bullish trend was likely to be strong over the next few days. The initial take profit at 1.9640 was changed to a limit sell order to exit 50% of my position. It was filled on 19 May 2021 14.38hr.

Disclaimer:

Trading and investment involves risk, including possible loss of principal and other losses. I shall not be responsible for any losses or loss profit resulting from trading or investment decision based on my posting and any information presented in this blog.

Comments

Post a Comment