FOREX AND CFD TRADES 1-5 May 2017

I made 7 FOREX and CFD trades last week. 3 made profits, 3 losses and 1 breakeven. Although my hit rate was only 50% but overall I made a gain of +2.58% of my account size. I risk 1% or less of my account size per trade.

Below are those trades.

AUDJPY (+1.78%):

This was a pullback trade within a bullish trend. I entered long at 83.175 after a bullish rejection candle was formed at the breakout pullback level of the previous swing high at 82.85. I placed my initial stop loss (SL) at 82.67 and take profit (TP) at 84.17. AUDJPY moved up as expected and reached my TP. It was closed at 84.171 for a +1.78% gain.

NZDUSD (-1.07%):

This was a pullback trade within a bearish trend. I entered short at 0.69151 after a bearish rejection candle at the potential resistance level. My SL was at 0.6945 and TP at 0.6855. I was stopped out at 0.6948 after a better than expected news on the NZD employment change and unemployment rate on 3rd May 2017. It was closed 3 pips higher because of slippage. I lost -1.07%.

AUDUSD (+1.88%)

AUDUSD was trading in a falling wedge within a volatile bearish trend. I entered short at 0.7530 after a bearish evening star pattern at the wedge upper line. My initial SL was placed at 0.7567 and TP at 0.7455. AUDUSD declined as expected and reached my TP at 0.74549 for a +1.88% gain.

It actually declined further and broke the wedge lower line.

SOYBNUSD (-1.0%)

SOYBNUSD was trading in a rising wedge within a bearish trend. I entered short at 9.59 after a false break of the wedge upper line. My initial stop was placed at 9.67 and TP at 9.45. The trade did not decline as expected. I was stopped out at 9.67 for a -1.0% loss.

SPX500USD (+0.13%):

SPX500USD was trading in a horizontal corrective structure within a bullish trend. I entered long at 2380.9 near the support level. My initial stop was at 2374 and TP at 2395. I moved my stop to breakeven (BE) +1 after the trade moved up by 1R. The trade then turned down to hit my BE+1 stop at 2381.9 for 0.13% gain.

SPX500USD later moved up and exceeded my TP level but I was already out of the trade.

WTICOUSD (+1.51%)

WTICOUSD was battered on 5th May 2017(Friday). This was a Head and Shoulder bottom reversal trade. I entered long at 45.199 after a bullish pin bar. My SL was at 44.55 and TP at 46.90. I closed the trade manually at 46.206 for a +1.51% gain since I did not want to be exposed to the weekend risk.

USDJPY (-0.65%)

I had expected USDJPY to decline further after breaking below its swing low. I entered short at 112.45 after the bearish rejection candle. My initial SL was at 112.85 and TP at 111.65. The trade did not decline as expected. I manually closed it at 112.717 for a -0.65% loss since I did not want to be exposed to the weekend risk.

Disclaimer:

Trading and investment involves risk, including possible loss of principal and other losses. I shall not be responsible for any losses or loss profit resulting from trading or investment decision based on my posting and any information presented in this blog.

Below are those trades.

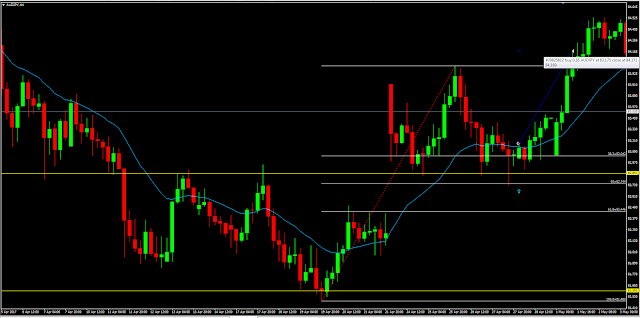

AUDJPY (+1.78%):

This was a pullback trade within a bullish trend. I entered long at 83.175 after a bullish rejection candle was formed at the breakout pullback level of the previous swing high at 82.85. I placed my initial stop loss (SL) at 82.67 and take profit (TP) at 84.17. AUDJPY moved up as expected and reached my TP. It was closed at 84.171 for a +1.78% gain.

|

| AUDJPY H4 CHART |

This was a pullback trade within a bearish trend. I entered short at 0.69151 after a bearish rejection candle at the potential resistance level. My SL was at 0.6945 and TP at 0.6855. I was stopped out at 0.6948 after a better than expected news on the NZD employment change and unemployment rate on 3rd May 2017. It was closed 3 pips higher because of slippage. I lost -1.07%.

|

| NZDUSD H4 CHART |

AUDUSD was trading in a falling wedge within a volatile bearish trend. I entered short at 0.7530 after a bearish evening star pattern at the wedge upper line. My initial SL was placed at 0.7567 and TP at 0.7455. AUDUSD declined as expected and reached my TP at 0.74549 for a +1.88% gain.

It actually declined further and broke the wedge lower line.

|

| AUDUSD H4 CHART |

SOYBNUSD was trading in a rising wedge within a bearish trend. I entered short at 9.59 after a false break of the wedge upper line. My initial stop was placed at 9.67 and TP at 9.45. The trade did not decline as expected. I was stopped out at 9.67 for a -1.0% loss.

|

| SOYBNUSD H4 CHART |

SPX500USD was trading in a horizontal corrective structure within a bullish trend. I entered long at 2380.9 near the support level. My initial stop was at 2374 and TP at 2395. I moved my stop to breakeven (BE) +1 after the trade moved up by 1R. The trade then turned down to hit my BE+1 stop at 2381.9 for 0.13% gain.

SPX500USD later moved up and exceeded my TP level but I was already out of the trade.

|

| SPX500USD H4 CHART |

WTICOUSD was battered on 5th May 2017(Friday). This was a Head and Shoulder bottom reversal trade. I entered long at 45.199 after a bullish pin bar. My SL was at 44.55 and TP at 46.90. I closed the trade manually at 46.206 for a +1.51% gain since I did not want to be exposed to the weekend risk.

|

| WTICOUSD H1 CHART |

I had expected USDJPY to decline further after breaking below its swing low. I entered short at 112.45 after the bearish rejection candle. My initial SL was at 112.85 and TP at 111.65. The trade did not decline as expected. I manually closed it at 112.717 for a -0.65% loss since I did not want to be exposed to the weekend risk.

|

| USDJPY H1 CHART |

Disclaimer:

Trading and investment involves risk, including possible loss of principal and other losses. I shall not be responsible for any losses or loss profit resulting from trading or investment decision based on my posting and any information presented in this blog.

Very useful information. CFD trading strategies are very helpful to make huge profit in CFD trading. Thanks for sharing

ReplyDelete