XAUUSD(Gold) Long Trade 28 Apr 2021 Breakeven+1

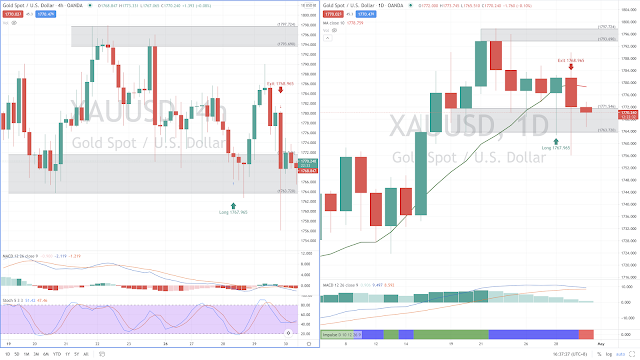

Daily chart:

10-day MA was angling up.

4hr chart:

Price was inside support zone and stochastic %K has reached oversold level at the time the trade was considered.

See XAUUSD daily and 4hr charts below.

ENTRY:

Buy order was filled on 28/4 at 1767.965 with stop loss at 1758 and take profit at 1795.

The stop loss order was raised to breakeven +1 at 1769 after XAUUSD has moved up to more than halfway to its take profit target.

Unfortunately XAUUSD upward move did not continue but instead it reversed direction to take out the revised stop loss order on 29/4 at 1768.965.

LESSON LEARNT:

XAUUSD formed a bearish pinbar after 3 consecutive green candles before it reversed direction on the 4hr chart. The pinbar is a bearish reversal candle - an indication that price may reverse direction. Next time will move the stop loss from breakeven to a few points below the low of the pinbar in order to protect the profit.

Disclaimer:

Trading and investment involves risk, including possible loss of principal and other losses. I shall not be responsible for any losses or loss profit resulting from trading or investment decision based on my posting and any information presented in this blog.

Comments

Post a Comment